5 Ways ChatGPT Can TRANSFORM Your Accounting Firm!

Jul 24, 2023

In this blog post, I'm going to share with you five practical use cases for how you can use ChatGPT in your accounting firm. These ideas will save you so much time and really demonstrate the power of ChatGPT.

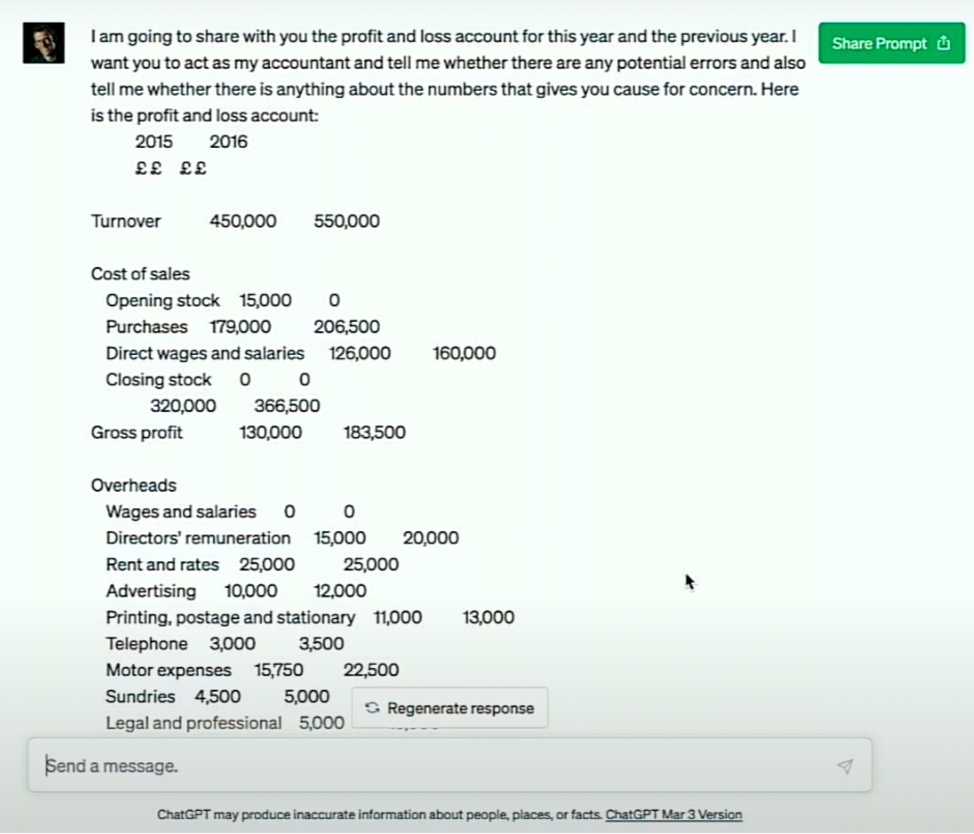

1. Data Analysis

The first use case is data analysis.

For example, you can feed ChatGPT with a profit and loss account for two years and ask it to act as your accountant. It will analyze the data and point out potential errors and anything about the numbers that gives cause for concern. Here is an example prompt. You can copy and paste your profit and loss account directly from Excel.

ChatGPT can pick up on some really useful factors. For example, it might notice a significant increase in both turnover and cost of sales between two years, suggesting that the business may have experienced growth or expanded its operations during this period. It could also highlight an increase in net profit before tax, which could be a positive sign of business growth and profitability.

This feature will save you loads of time with just an initial glance to see if the data is correct or not.

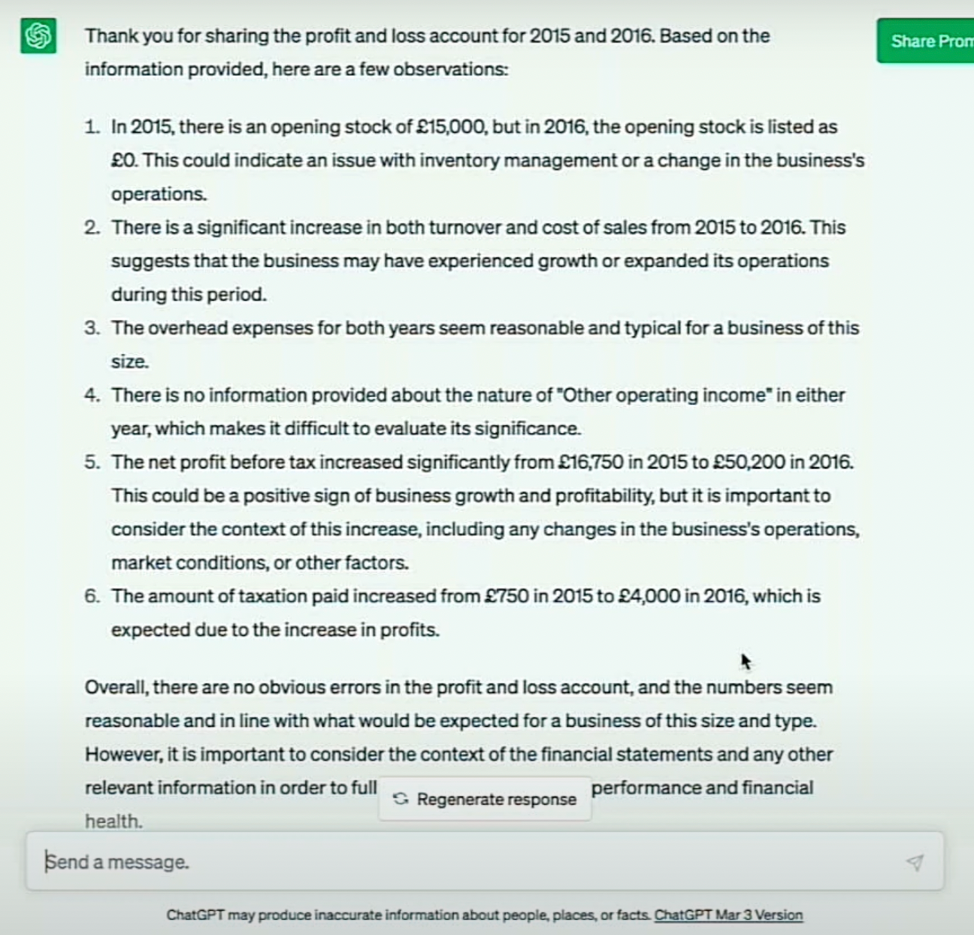

2. Tax Summaries

The second use case is creating tax summaries. While ChatGPT doesn't necessarily have up-to-date information, you can feed it with the latest tax guidance notes from tax authorities. Once it has this information, you can ask it to summarize these notes in less than 500 words, suitable for a blog post or newsletter article.

For example, you could ask it about the deadlines for a client residing in France who has just sold a property in London. It will provide an answer based on the information you've fed it from the UK government's tax website. This is a great way of getting an answer fast to tax questions.

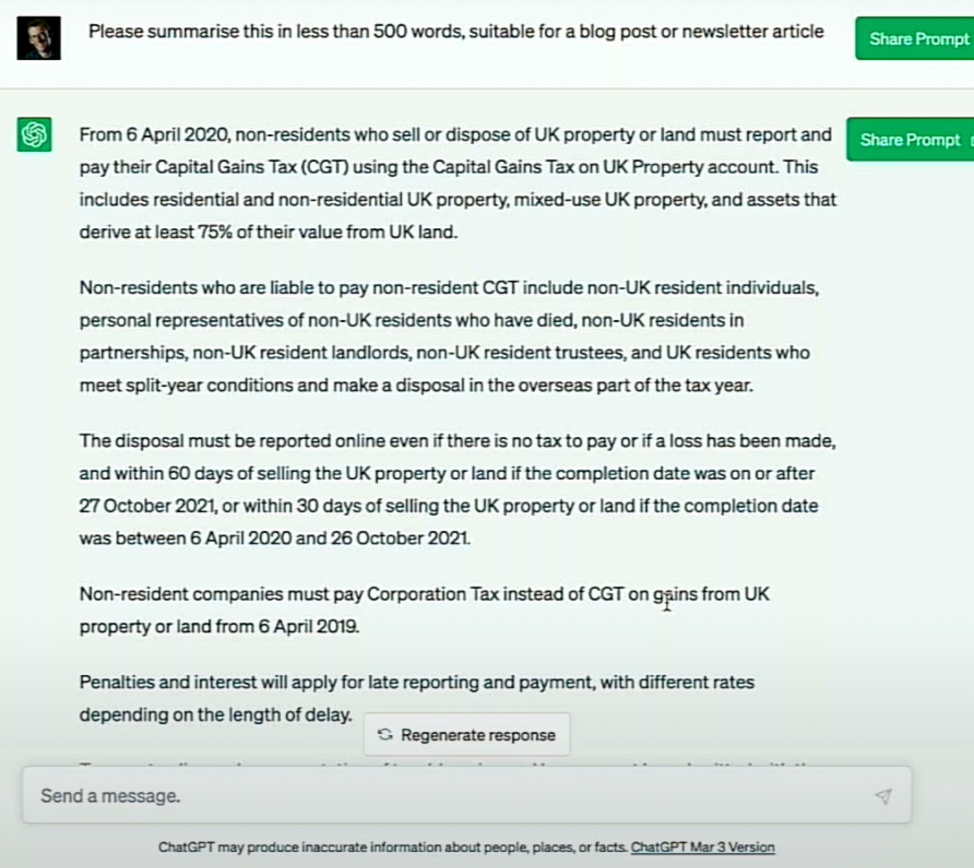

3. Idea Generation

The third use case is idea generation.

For example, if you're an accountant specializing in small construction businesses and you're looking for some ideas for a blog post about cash flow management, ChatGPT can provide you with five possible blog post ideas. For each blog post idea, ask it to include three main points you should cover.

This feature is great for coming up with ideas for your content marketing strategy.

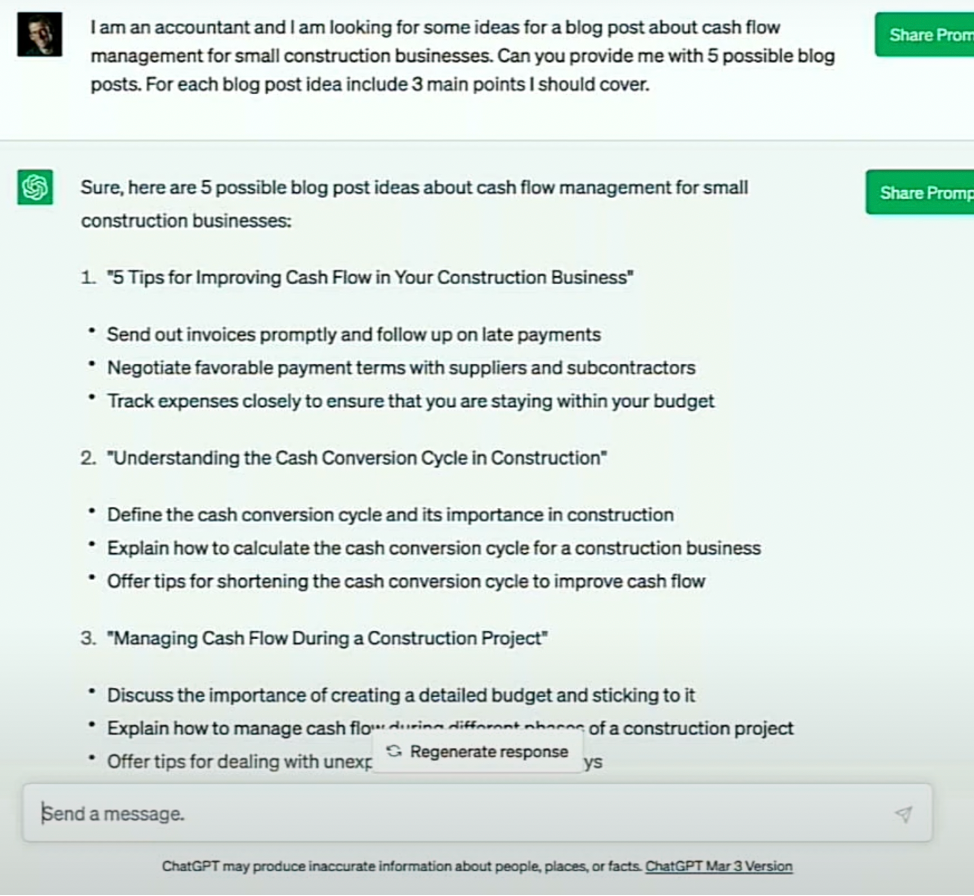

4. Content Creation

The fourth use case is content creation.

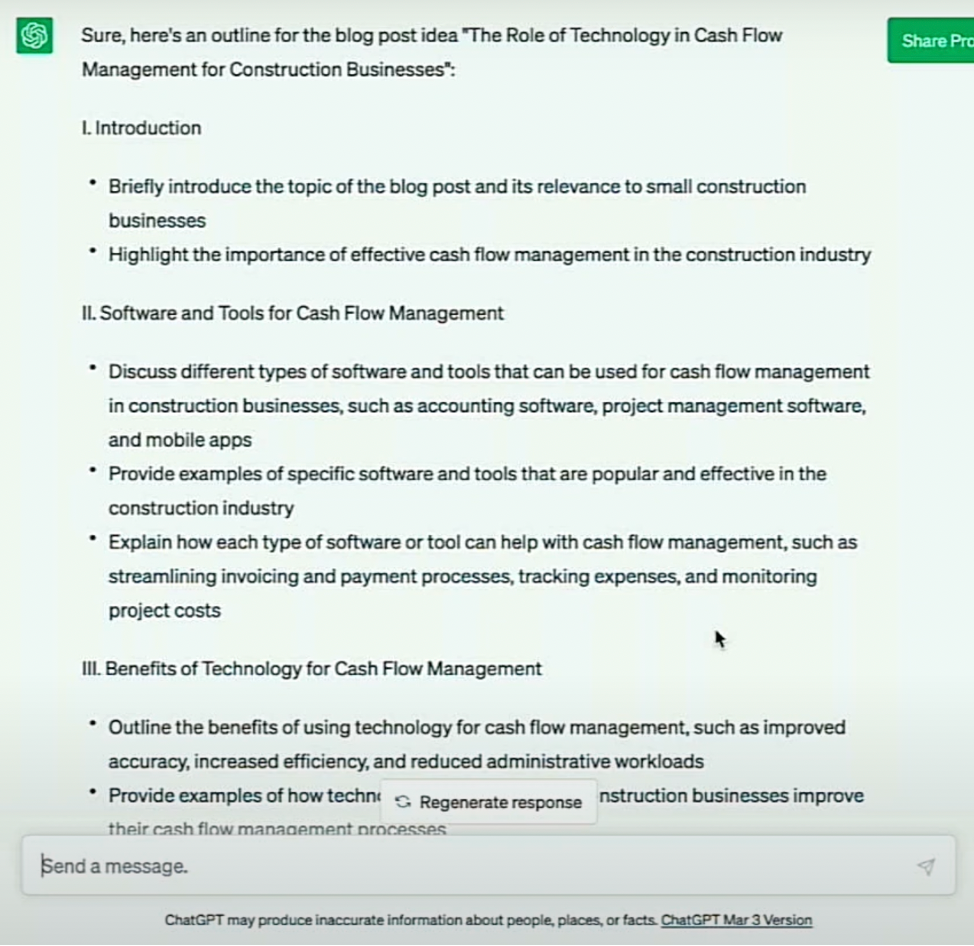

Once you have your blog post ideas, you can ask ChatGPT to help you write the blog post. You can ask it to provide a blog post outline for your chosen idea, and give you a detailed outline, including an introduction, main points, and a conclusion.

For instance, for a blog post about "The Role of Technology in Cash Flow Management for Construction Businesses," it might suggest talking about software and tools for cash flow management, the benefits of technology for cash flow management, and selecting the right technology solutions.

5. Marketing

The fifth use case is marketing.

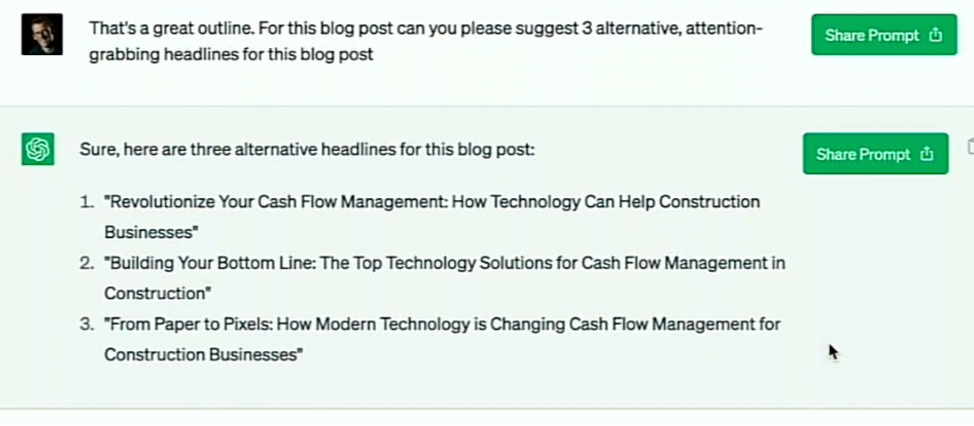

Once you've written your blog post, you'll want to post it. ChatGPT can help you write great headlines for your post. You can ask it to suggest three alternative attention-grabbing headlines for your blog post, and it will provide you with creative and engaging headlines.

More Resources

If this is a topic that interests you, my team and I recently wrote an eBook all about ChatGPT for Accountants and Bookkeepers. It’s full of tips, advice, and worked examples. You can download your FREE copy here.

If you want to keep learning more about AI and ChatGPT, you can join a community of Accountants and Bookkeepers learning together in our Facebook Group here: www.facebook.com/groups/aiforaccountantsandbookkeepers

And finally, you can watch the full video on this topic here.

If you found this valuable and would like to learn more about value pricing, I run a free live online training session every month with a topic chosen by you. Attend live and you can ask me any questions you have. Click here to register and I will send you an invitation to the next session.

Wishing you every success on your pricing journey

Mark Wickersham

Chartered Accountant, Public Speaker and Author of Amazon No.1 Best Seller “Effective Pricing for Accountants”